Refinance Options

Have questions about your mortgage options? We're here to help you make confident, informed decisions.

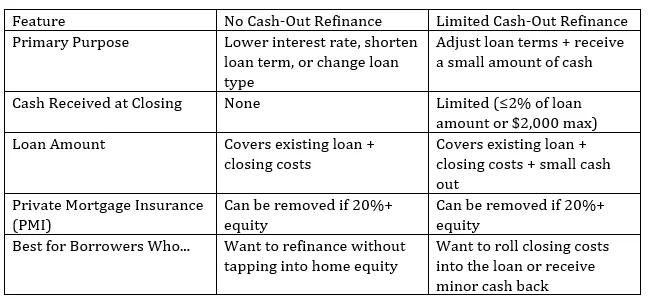

No Cash-Out Refinance vs. Limited Cash-Out Refinance:

What You Need to Know

If you’re considering a rate-and-term refinance, you have two primary options: a No Cash-Out Refinance and a Limited Cash-Out Refinance. While both allow you to adjust the terms of your mortgage—such as reducing your interest rate or changing your loan term—they differ in how much, if any, cash you can receive at closing. Let’s break down the key differences, benefits, and how to decide which option is right for you.

🔹 What is a No Cash-Out Refinance?

A No Cash-Out Refinance is a loan that allows you to replace your existing mortgage with a new one, typically with a lower interest rate, shorter loan term, or both—without receiving any cash at closing.

✅ Main Purpose: Lower interest rate, shorten loan term, or change loan type

✅ Cash Received at Closing: None (under $500)

✅ Max Loan Amount: The new loan cannot exceed the balance of the original mortgage plus allowable closing costs

✅ Common Uses:

✔ Lower monthly payments

✔ Switch from an ARM to a fixed-rate loan

✔ Remove private mortgage insurance (PMI)

✔ Pay off a higher-interest second mortgage

💡 Best For: Homeowners who want to refinance for better loan terms without taking out additional cash.

🔹 What is a Limited Cash-Out Refinance?

A Limited Cash-Out Refinance allows homeowners to refinance their mortgage and receive a small amount of cash at closing—usually to cover closing costs or other minor expenses. The amount of cash received is limited, typically not exceeding 2% of the loan amount or $2,000, whichever is lower (depending on lender guidelines).

✅ Main Purpose: Adjust loan terms while receiving a small amount of cash

✅ Cash Received at Closing: Limited (typically 2% of loan amount or $2,000 max)

✅ Max Loan Amount: The new loan covers the existing mortgage balance, closing costs, and small additional cash back

✅ Common Uses:

✔ Roll closing costs into the loan to avoid upfront payments

✔ Pay off small debts or liens

✔ Reimburse yourself for minor home repairs or improvements

💡 Best For: Homeowners who want to refinance without taking significant equity out but need a small amount of cash for expenses.

🔹 Key Differences Between No Cash-Out & Limited Cash-Out Refinances

Use this worksheet to compare No Cash-Out and Limited Cash-Out Refinance options to determine which one best fits your financial goals.

🔹 How to Decide Which Refinance Option is Right for You

Ask yourself these key questions when choosing between a No Cash-Out Refinance and a Limited Cash-Out Refinance:

❓ Are you primarily refinancing to lower your interest rate or adjust your loan term?

✅ Choose a No Cash-Out Refinance if you don’t need additional funds.

❓ Do you want to include closing costs in the loan instead of paying them upfront?

✅ A Limited Cash-Out Refinance allows you to roll closing costs into the loan and avoid out-of-pocket expenses.

❓ Do you need a small amount of cash for minor expenses but don’t want a full cash-out refinance?

✅ A Limited Cash-Out Refinance is ideal if you need just a little extra cash without significantly increasing your loan balance.

❓ Are you trying to remove private mortgage insurance (PMI)?

✅ Both options may allow you to eliminate PMI if your home has 20%+ equity.

🔹 Final Thoughts: Which Refinance Option is Best for You?

A No Cash-Out Refinance is the best choice if you’re simply looking to secure a better interest rate or loan term with no additional cash needed.

A Limited Cash-Out Refinance can be a smart move if you want to cover closing costs, reimburse yourself for small expenses, or roll minor debts into your mortgage—without turning your home equity into a full cash-out loan.

📞 Still unsure which refinance option is right for you? Let’s review your goals and find the best solution for your financial situation!

Let’s make it official! Start your mortgage application now — quick, secure, and no pressure.

Not ready yet? That’s okay — get started at your own pace with our free Edge Loan Advisor app. Explore loan options, calculate payments, and prepare when you're ready.

Whether you want to speak to a Loan Guide or just have a general question — we're ready to go!

Ready to dive a little deeper? Let’s talk through your goals and explore your options together.

Licensed in GA, FL & TN

Able to handle loans in 40 States but will be 50 states soon

No question is too small — we’re happy to walk you through it.

Ready when you are — just send us a quick note.

Edge Home Finance Corporation © 2024. All Rights Reserved. NMLS #18796 Company NMLS #891464

Licensed In: AL, AR, CA, GA, FL, OH, TN

Edge Licensed 48 states Iwww.nmlsconsumeraccess.org