Explore strategies, loans, and insights to grow your portfolio and your future

Apply in less

than 10 min

More Loan

Options

Fast pre-approval

you can count on

Your Guide to Financing, Owning, and Profiting from Investment Properties

Real estate has long been one of the most powerful tools for building wealth —and owning an investment property is one of the most accessible ways to start. Whether you're looking to generate monthly rental income, build equity over time, or diversify your financial portfolio, this guide breaks down what you need to know to make smart, strategic moves in the investment property world.

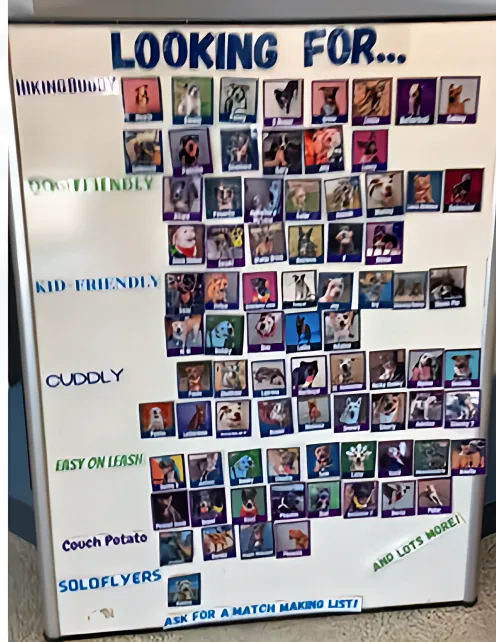

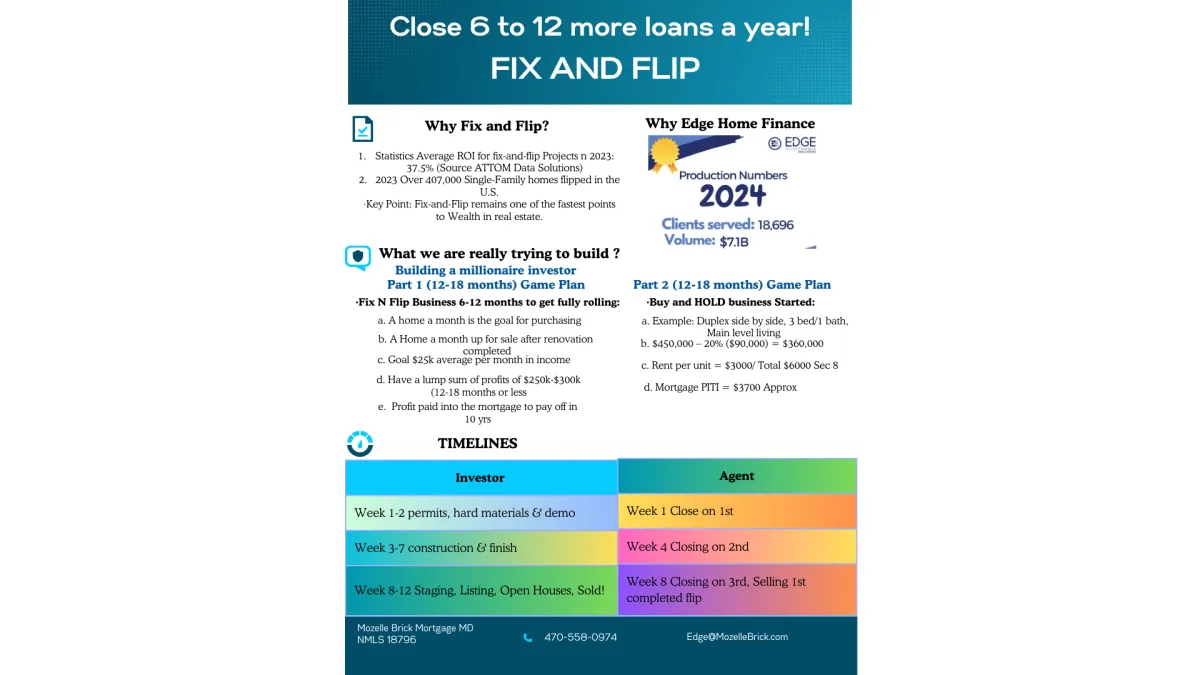

Fix N Flips

DSCR – Property Qualifies, Not You

Why Invest in Real Estate?

Passive income: Rental properties can provide consistent monthly cash flow.

Appreciation: Properties tend to increase in value over time, building equity and net worth.

Tax advantages: Investors can benefit from deductions, depreciation, and 1031 exchanges.

Leverage: You can use financing to grow your portfolio faster than with cash alone.

Financing Your Investment Property

Unlike a primary residence, financing an investment property comes with different requirements:

Higher down payments: Typically 15–25% depending on the loan type.

Stricter credit and income guidelines

Interest rates: Slightly higher than owner-occupied loans

At Edge, we have access to over 150 lenders, which allows us to find you great rates and loan structures—whether you're buying your first rental or expanding your portfolio. Some of the most common loan options include:

Conventional investment loans

DSCR (Debt Service Coverage Ratio) loans

Portfolio and blanket loans

Asset-based and stated-income programs

We also offer niche lending solutions that many banks can’t—perfect for self-employed investors, flippers, or those working with short-term rentals.

Owning and Managing Smartly

Success doesn’t stop at the closing table. Key considerations for managing your property include:

Rental strategy: Long-term, short-term (Airbnb/VRBO), or mid-term rentals

Location analysis: Focus on cash flow, appreciation potential, and tenant demand

Property management: Decide between self-managing or hiring a professional

Maintenance planning: Keep your investment in great shape while protecting profits

Maximizing Profit

Owning is one thing—profiting is another. Here's how to make the most of your investment:

Track income and expenses carefully to maintain cash flow and tax efficiency

Reinvest profits into renovations or future properties

Monitor the market to time refinancing or equity pulls

Use our Edge Loan Advisor tool to map your financial fitness, analyze opportunities, and optimize your long-term strategy

Let’s Build Wealth—Together

At Edge, we go beyond the loan. We help you create a roadmap to financial freedom through real estate. Whether it’s your first investment property or your fifth, our team, tech, and tools are here to guide you every step of the way.

Let’s review your situation together! 📞 Contact me today for a no-obligation consultation!

Edge Home Finance Corporation © 2024. All Rights Reserved. NMLS #18796 Company NMLS #891464

Licensed In: AL, AR, CA, GA, FL, OH, TN

Edge Licensed 48 states Iwww.nmlsconsumeraccess.org